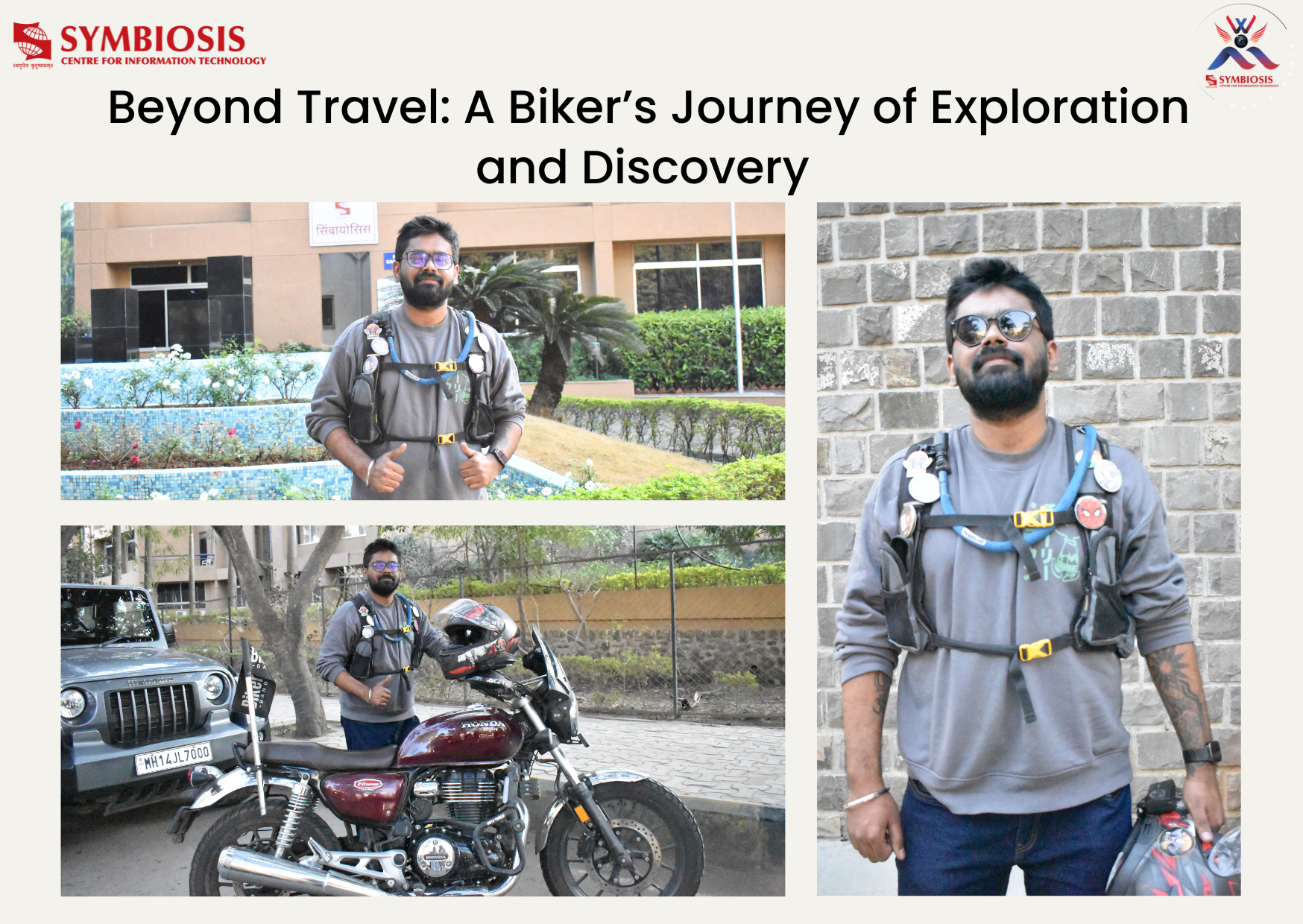

“Ageing Dragon and Loosing Tiger” – Beginning of Fall of ChinIndia

Merely before two years, the world was talking about rising Asia and BRIC countries and their increasing global footsteps. People were talking about Asia’s rising stars, India and China. The 10% GDP growth in 2010 has made the world think about considering India as the next superpower. World was talking about repetition of history where India and China stood as number one and two economies.(For ref: Read Wikipedia about History of Global economies).

But now, It seems that India and China are losing their shine. Two Major economies of Asia are giving timid signs. In the first quarter of 2012 India’s Economy was growing at 5.3(ref 3) lowest in 9 years and China’s economy expanded at 8.1% (ref 2)which is a 3 year low and in the second quarter at 7.6%(ref 1). Rupee remains worst performing currency which lost over 18% in the past year against US dollar(ref 4). China’s currency Yuan (Renminbi) which is regulated by People’s Bank of China is also under pressure because of having slow growth rate for six straight quarters.(ref 5).

India has many internal factors responsible for its sluggish economic behavior. These internal factors varies from bad politics and poor education to poor infrastructure. The main problem which comes out of all factors and is mainly responsible for under performance of Indian economy is Indian Politics. Indian law allows many parties to come and elect people in government. So many times it results into coalition government in which no one agrees which each other’s point of views most of the time. Current examples are disputes between NCP and Congress and continued altercation between Mamta and Congress over FDI and Petrol price rise. These disputes in government give a very bad sign to the Industry and the world. Many economic reforms, policies and laws are stalled only because of having no political consensus in the ruling party. Major stalled reforms include FDI, GAAR, fuel subsidy reform, FDI in civil aviation, goods and services tax (gst) etc. Controversial probable retrospective Tax amendment to tax law has also irked foreign investors.

Problem with China’s economic model is again obsolete political-economic model. Chinese dictatorship on its economic policies is no longer working. Control over financial system by the state authorities is the main cause of concern for economy. Currency Yuan is regulated by People’s bank of china. China deliberately undervalues its currency to help its exports gain more and reduce trade deficit. It manipulates it currency to lower the trade deficit and in turn increases its gross domestic product. China is already going through slow manufacturing growth this month(Aug’12). Reduction in investment has also contributed to its slow economic growth. China is believed to be hiding the reality of its current economy and manipulating GDP growth , Currency and other statistical data. There are many evidences which show how china is falsifying economic statistics to hide true depth of troubles.

So Both countries need to work on their internal matters. India needs to change political structure , legal structure and Education. Whereas China needs to work on management of Government regulated economy and should become more transparent in terms of statistical data of its economy. China should also make its currency free floating as per market rate in order to underestimate or overestimate economic conditions in country.

Additional References :-

1) http://www.thejakartapost.com/news/2012/08/23/is-china-s-economic-slowdown-structural.html

2) http://www.chinausfocus.com/finance-economy/chinas-economic-slowdown-is-no-cause-for-alarm/

4) http://www.creditwritedowns.com/2010/03/this-is-the-problem-with-chinas-currency-peg.html

6) http://in.reuters.com/article/2012/06/25/india-economy-reforms-idINDEE85O00E20120625

Ravi Soni

MBA-ITBM SCIT (2012-14) 🙂